Kyle Prevost, creator of 4 Steps to a Worry-Free Retirement, Canada’s DIY retirement planning course, shares financial headlines and offers context for Canadian investors.

U.S. inflation continues to ease; rates unchanged

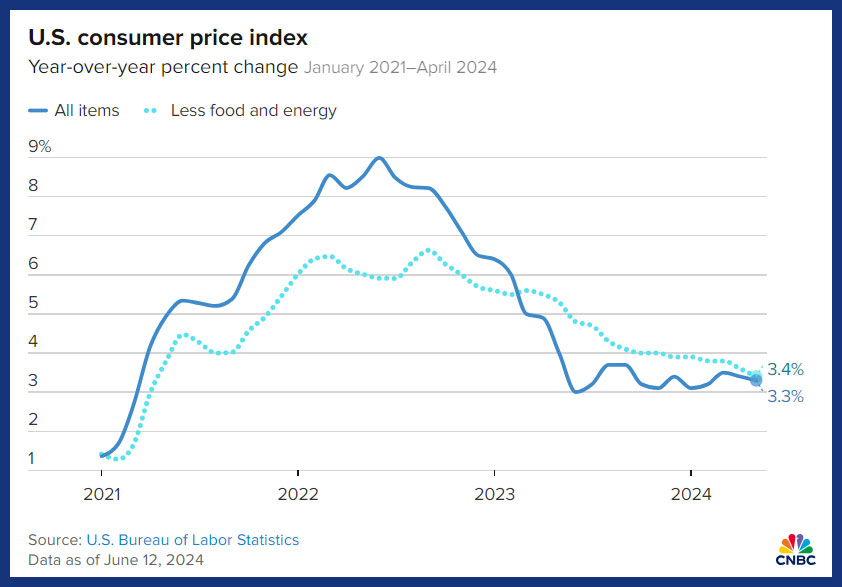

The U.S. Consumer Price Index (CPI) revealed a flat (0%) inflation rate in May, which was up 3.3% year over year. These numbers were slightly lower than expected and they show that inflation is cooling, which we’re seeing throughout most of the world.

Highlights of the U.S. CPI report

Some takeaways from the June 12 report.

- No change in the CPI (flat) from April to May.

- CPI was up 3.3% year over year.

- Core CPI (which factors out volatile cost factors such as food and energy) rose 3.4% on year over year.

- Energy costs fell 2%, while gasoline costs were down nearly 3.6%.

- Shelter costs continue to be an outlier coming in at a 5.4% increase year over year.

After releasing the inflation report on Wednesday, the U.S. Federal Reserve announced it would hold interest rates at its current range of 5.25% to 5.5%.

We see today’s report as progress and as, you know, building confidence. But we don’t see ourselves as having the confidence that would warrant beginning to loosen policy at this time.”

—Jerome Powell, U.S. Fed Chair

There was clearly a general softening of the “higher for longer” talk that was prevalent in recent statements from the central bank.

When asked about the disconnect between the thriving U.S. economy and general perceptions of economic malaise, Powell answered, “I don’t think anyone has a definitive answer why people are not as happy about the economy as they might be.”

Read: “What is the inflation rate in the U.S.?”

U.S. tech continues to outperform

While Nvidia is rightfully getting the lion’s share of press coverage when it comes to U.S. tech these days, Oracle and Broadcom proved this week that there are plenty of opportunities for investors. All numbers for Oracle and Broadcom are in U.S. dollars.

U.S. tech highlights

Here’s a snippet of what was in the latest earnings reports.

- Oracle (ORCL/NYSE): Earnings per share came in at $1.63 (versus $1.65 predicted), and revenues were a slight miss as well at $14.29 billion (versus $14.55 billion predicted). However, share prices were up 11% in extended trading on Tuesday after earnings were announced.

- Broadcom (AVGO/NASDAQ): Earnings per share came in at $10.96 (versus $10.84 predicted), and revenues were $12.49 (versus $12.03 billion predicted). Share prices were up 10% in extended trading on Wednesday after earnings were announced.

Broadcom cited the increased demand for its AI chips (although not nearly on the scale of Nvidia) for its positive earnings report. It also acquired a software company called VMware in late 2023 for $69 billion. Consequently, its overall revenue was up 43% year over year.

Oracle’s earnings day was perhaps even more interesting, as investors reacted positively to the overall earnings report despite earnings per share and revenues for both coming in slightly below expectations. The positive sentiment was mostly credited to increased projected profits from cloud infrastructure. Cloud-based revenue was up 42% from last quarter and is growing more quickly than competitors Amazon Web Services and Microsoft Azure.

CEO Larry Ellison was excited to announce that Oracle was building some of the world’s largest data centres. “Some are getting close to, dare I say it, a gigawatt, which is a pretty good-sized city or one enormous AI cloud training data centre.”

It appears the rising AI tide continues to lift all boats in the U.S. tech sector.

Deal-seeking customers power Dollarama

It was a quiet week for Canadian earnings announcements, with Dollarama (DOL/TSX) being the only large company to release quarterly results. Some Canadian investors might not realize that this humble dollar store is actually the 33rd biggest company in Canada, making it larger than Telus, Rogers or Fortis.

Dollarama earnings highlights

Here’s what the thrifty retailer announced this week:

- Dollarama (DOL/TSX): Earnings per share of $0.77 (versus $0.75 predicted), and revenues were identical to the $1.41 billion expert prediction.

Comparable store sales were up 5.6%, and there are plans to add 60 to 70 new stores to the list of 1,551 existing Canadian stores.

“As anticipated, we are seeing a progressive normalization in comparable store sales, with growth primarily driven by persistent higher than historical demand for core consumables and other everyday essentials.”

– Neil Rossy, Dollarama CEO

Despite the positive news, share prices dropped on the heel of news for an aggressive expansion under the Dollarcity subsidiary in Latin America. The $761.7 million investment grows Dollarama’s total equity from 50.1% to 60.1%.

“We look forward to preparing for entry in Mexico in the near term, a large and dynamic market with untapped potential in the value retail space, guided by the same careful and disciplined approach as with our successful entries in Colombia in 2017 and in Peru in 2021.”

– Neil Rossy, Dollarama CEO

Long-term Dollarama shareholders are probably quite happy despite the pullback, as the stock is up a scorching 26% year to date, and 42% over the last 12 months.

Read: “Dollarama earnings report and upcoming growth”

Stock splits for Nvidia and Canadian Natural Resources

If you were recently looking at the stock prices of Canada’s sixth largest company, Canadian Natural Resources (CNQ/TSX), and the world’s third largest company, Nvidia (NVDA/NASDAQ), you might be alarmed to see steep price declines. No need to panic; this is simply the result of stock splits. (Read: “What does Nvidia’s stock split mean for Canadian investors?”)

Early this week, CNQ executed a 2-for-1 stock split, and Nvidia executed a 10-for-1 stock split. (Broadcom also announced that it too would be undertaking a 10-for-1 stock split in the near future.)

What does this mean? CNQ shareholders received two shares for every share they used to hold. Similarly, Nvidia shareholders got 10 shares for every share they used to hold.

But, the share prices were now worth less than they were before the stock split. At the end of all the stock splitting, the overall value of your investment in CNQ, if you own it, did not change.

Companies often do splits to make their stocks more accessible to investors. If a share’s price climbed to figures out of reach for many investors, it could limit the company’s access to capital. After all, not everyone has a thousand bucks lying around to purchase a single share. So, to attract as much investment capital as possible, the company can reduce the cost of a single share, making it accessible for all investors and maximize their liquidity. (Canadian Natural Resources is among MoneySense’s list of best dividend stocks in Canada and the top Energy stocks for 2024 at MillionDollarJourney.com.)

Broadly speaking, stock splits are indicative of a confident management team, and usually occur after a company has experienced an extended period of solid growth. That said, the stock split doesn’t necessarily indicate anything about the future (no one knows what the future will be). So, we wouldn’t recommend making any investment decisions on the sole basis of a recent stock split.

The key thing to understand is that the asset that investors owned before the stock split is worth exactly the same amount as the shares after the stock split. Think of all of the companies’ shares added together as being a giant pizza. If you have four people to share the pizza, you can cut the pizza into four pieces, eight pieces, or 40 pieces. At the end of the day each person is going to eat the same amount of pizza.

Read more about investing:

- Best ETFs in Canada

- National Bank to buy Canadian Western Bank at $5 billion valuation

- How much is capital gains tax and other questions answered

- Will the AI “gold rush” last?

The post Making sense of the markets this week: June 16, 2024 appeared first on MoneySense.

0 Commentaires